There seems to be an app for everything in the app store on your phone or mobile device. In fact, you probably expect to find exactly what you are looking for. So do most consumers. Financial institutions have been catching on to this trend and changing business practices accordingly.

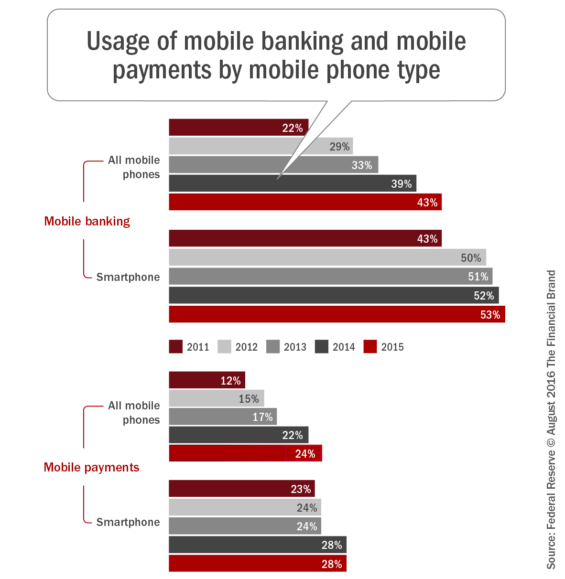

Usage of mobile in finance

When you look at the financial world, most banks and financial institutions have mobile services and apps for smartphones tablets, and even wearables. These cover things like banking, making payments, tracking investments, accessing information, and a variety of other services.

Mobile services have grown year after year for many years and companies work hard to innovate their services to continue this growth. Consumers have begun to rely on mobile devices so much so that a company without an app is at a competitive disadvantage. There is no doubt that this aspect of finance will continue to grow as consumers demand more mobile services.

The developing world

Another large part of the growth in mobile is targeting the developing world. Many companies are tapping into all the wealth of countries outside the developed world. People in these countries may not have access to banks, but they do have access to mobile devices and strong internet services.

8 examples of innovations of mobile services

Below, is a small sample of the innovation of mobile services in traditional financial institutions as well as fintech.

1. Citibank

While wearables have not made a huge dent in the market yet, Citibank wants to be one of the first to make its mark in terms of finance. They developed an app for the Apple Watch which lets customers check account balances and recent transactions. They also use a color system where the watch displays a color depending on how close customers are their credit limits.

2. Pockets

In India, ICICI bank worked with IBM to create the Pockets app. This app was described as “India’s first digital bank for youth.” Users download the app to create a digital wallet. They can then transfer funds to bank accounts, email addresses, mobile numbers, and social network accounts. Other features include bill pay, money requests, savings accounts, online shopping, among others. ICICI Bank wanted to create a full service shopping and banking app.

3. Structured Products Selector

BNP Paribas is one of the largest banks in the world. They operate in 30 countries and manage almost €300 billion worth of investments. They created an app to deliver up-to-date information with all their customers.

4. Danske Bank

Wanting to improve their payment technology, Danske Bank partnered with GoAppified and Netclearance to use beacons to improve the payment experience. Customers go to a retailer and pass their phones over the beacon. It connects to the phones MobilePay app and sends the customer a notification asking them to approve the transaction. They swipe right and the payment goes through. Many banks are following Danske Bank’s lead and starting to install beacons to improve the payment process.

5. Bim

The use of mobile has opened up banking services to many people who did not have them in the past. ASBANC, Peru’s National Bank Association, has launched Bim, a mobile wallet platform for mobile phones. With it, people can now open bank accounts, make financial transactions, and access other financial services right from their phones. All of this can be done without ever visiting a bank. Mobile technology opens the doors to financial services to many people who can not access traditional banking services. This will continue to improve as many banks are creating mobile apps and some banks are going entirely digital.

6. PlayMoolah

For a different kind of mobile financial application, you can explore the PlayMoolah platform and app. This app was created to teach children and adults financial literacy. The app uses games and other interactive features to help people learn about how to handle money, invest, save, and various financial challenges that come up at various stages of life.

7. Amazon Cash

Amazon seems to be continuing their domination of all things shopping related with this mobile service. Amazon Cash users do not need a bank account. All they need is an Amazon account and a smartphone. They can go to a participating retailer, put some money in their account, and then pay for goods on Amazon without needing a card or bank account of any kind.

8. Wallaby

Credit risk and behavior is difficult to track for consumers. A credit score seems like a random number that people only think about when they have take out a loan or make a big purchase. Wallaby is an app that helps consumers improve their credit. It tracks their score and gives them personalized recommendations based on financial behavior.

More examples

There are so many companies to list, many of which are in the payments sector. Square, iZettle, LoopPay, Stripe, Boku, Fortumo, SumUp, Revel, and Zoop are just a few. Dwolla is a mobile app that allows customers to send and receive money, while Beamm and Freshbooks help small businesses manage various aspects of finance.

Mobile will continue to grow

There are so many areas of finance that use mobile to connect to customers and businesses. Based on the data, mobile will continue to grow in the developed and developing world, opening up banks and consumers to new ways of doing things for years to come.

![Also read: Finance 2022: 10 Tech Trends [e-book]](https://no-cache.hubspot.com/cta/default/2537587/4e684d13-985d-4253-a9c7-9b7c31105c47.png)