Over the course of the last decade, more and more people have come to rely on mobile devices. By 2021, there will be almost 9 billion mobile phones and 16 billion IoT devices in use around the world. Around 90% of data will come from smartphones. Not only will the use of these mobile devices increase, they will also become more technologically advanced.

More mobile options in Finance

The finance industry has had to keep up with technology for their own business needs, as well as to meet the demands of customers who want more mobile options.

1. Mobile banking

By some estimates, 15% of bank users around the world are mobile only users. This percentage does not include the people who use mobile services in addition to standard services. The percentage of mobile-only bank users is expected to grow over the next few years and both standard banks and digital banks are investing a lot in mobile apps and services.

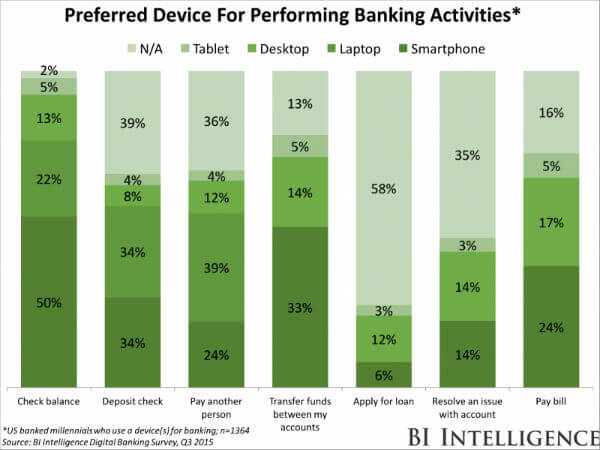

As the graph below shows, more and more people are relying exclusively on mobile devices like tablets and smartphones to perform various actions, checking the balance of an account and transferring funds being the most common.

2. Biometric

Many mobile apps are also using biometric login methods like fingerprint scanners, face recognition, and voice recognition. HSBC and Barclays have been incorporating these types of systems into their online banking services. This provides faster and more efficient service than alphanumeric passwords and over 78% of people are confident that these types of passwords are secure.

3. Peer-to-peer payments

Many people, especially younger generations, are turning to mobile devices to make payments. Phones, tablets, and mobile apps can store credit card and bank information so that consumers can make payments without the need for cash, bank cards, or credit cards.

In a recent survey of Millennials, 71% stated that it’s very important to have a banking app. 60% of them also feel that it’s important to have an app to make payments. In fact, 27% use their phones to make payments at stores on a monthly basis. That number is sure to increase as smartphone use continues to grow.

These types of payments are now an aspect of social media. Facebook introduced a peer-to-peer system in its messaging system to allow its billion users to make payments to each other. Snapchat also introduced Snapcash, a platform for sending money.

4. Gamification

Many financial institutions are just beginning the process of incorporating elements of gamification into their apps. The hope for many leaders is that mobile apps can help people keep track of their spending habits and other aspects of finance through game-like elements within the app.

6. Security

A lot of sensitive data travels between various devices when it comes to finances. With the increase in mobile technology, banks and other institutions are working hard to make mobile security a priority. In order to protect financial data, they have already started creating their own apps so that consumers do not have to use third-party apps, which may not secure data as well.

Part of this push for security is the introduction of blockchain technology. IBM recently found that financial institutions are adopting blockchain much faster than expected, with 15% of the major banks around the world introducing blockchain products within a year. This technology makes mobile more secure as it digitally tracks payments and other assets as they move from one place to another.

7. Services

IoT has changed the way banks and other institutions interact with consumers. Beacons attached to ATMS and banks can transfer data to mobile devices alerting consumers to various services, updates, or other important information about the bank or consumer’s account.

8. Micropayments

The majority of mobile payments most consumers make are what many people call micropayments. These are very small payments, usually less than one dollar, euro, or pound. Many consumers are comfortable making these types of payments as they are common when buying music, apps, or articles from magazines and newspapers. There is a trend toward making larger payments using a mobile-only transaction, but there are still limited in comparison to micropayments.

9. Education

Mobile technology not only helps people manage their money but it also helps them understand finance. Users are able to learn about various aspects of finance through microlearning, video, and text. They are also able to communicate with finance professionals to see how they should best invest or manage their assets.

10. Investing

Not only are consumers able to manage their banking and payments through a mobile device, they can also manage their stock portfolios. There are many apps which allow consumers to see the value of their investments, get stock prices in real-time, and make trades.

Finance has to keep up

As consumers become more and more attached to their mobile devices, they will expect more from financial institutions in terms of managing their money from anywhere. Consumers want to take more of their lives with them wherever they go and money is a vital aspect of life.

![Also read: The Fundamentals of Machine Learning [whitepaper]](https://no-cache.hubspot.com/cta/default/2537587/a99b0d59-c31f-4258-98ca-dc1b83034af7.png)