When I got a call this week from my bank representative, I was confused as I looked at my phone screen. For a moment there, I hesitated. As far as I knew I had no issues with my bank account, with my card, I couldn’t imagine why they would call. I picked up and surely enough my fear was confirmed - they wanted me to come into the bank to discuss a new offer they had on long-term deposits. Of course their banking hours were overlapping with my work schedule so I would have had to leave work early or sacrifice a break. I politely declined their invitation and went on with my day. I dodged it this time but I knew that when my card expires or any of my personal details change, I would have to go in.

And this is why I love virtual banking. I love to pay all my bills from the comfort of my virtual bank. I like to transfer funds and manage deposits in my living room, in my pajamas. And I wish virtual banking would fulfill its true potential and stop these phone calls and invites to the bank. I can’t, for the life of me, understand why I’m paying for my Internet banking services but there are still so many things that I can’t operate from my account and for which I have to go to the bank.

Essentially, virtual banking allows me to access my banking info and related services online without actually going to the bank branch in person. It enables me to pay bills online, check account details, secure loans, withdraw and deposit money anytime as per my convenience, this being the first big advantage I see. The second one is that transactions can be checked in real time, so when I make a transaction, I’m not required to wait for the day or a month to end to check the transaction details. As a consequence of this, I recently learned, the cost incurred in handling the transactions is lower than the traditional form of banking, and also, it charges low fee comparatively because of less overhead expenses. So why isn’t everyone as in love with virtual banking as I am?

What’s the technological holdup?

I went on to investigate this matter of virtual banking and how to make it work for me (sooner). What I found out was that the technology is already here, validating some of my expectations.

“What is it exactly that sets a virtual branch apart from regular internet banking? Well, imagine simply that you don’t have to go to your local bank branch anymore, because you can get all you need through live video chats with financial experts, real-time desktop sharing, co-browsing, voice biometrics, on-screen signing and – and all those options come through a secure connection.

![Also read: The Fundamentals of Machine Learning [whitepaper]](https://no-cache.hubspot.com/cta/default/2537587/a99b0d59-c31f-4258-98ca-dc1b83034af7.png)

What's more, even the most complex banking services, including obtaining a mortgage, are available from the comfort of your home, or wherever you happen to be as long as there's an Internet connection on hand.”

So it is possible for me to do all my banking without setting a foot inside an actual bank? Theoretically, yes. So what's the holdup?

It seems that virtual banking branches are still at an early stage of market adoption. Although it is expecting to have a fast growth rate, with as many as four out of five banks expected to be involved in virtual branch deployment by 2018, according to EFMA (the European Financial Management Association), I don’t think I’ll personally benefit from this anytime soon.

These new technologies including augmented reality, virtual reality and chatbots are all being tested by financial institutions to see how they can impact the overall functioning of the banking system. For example, Bank of America is experimenting with hybrid banking, supplementing traditional branch offices with small unstaffed mini-branches that offer a direct link to branch personnel via video conference, and with voice recognition technology as well. Using Erica (as in Bank of Am-ERICA), Bank of America customers could do virtual banking by voice with a computer, similar to how people already use Amazon Alexa or Apple’s Siri. Some banks are experimenting with AR apps to help consumers find the nearby branches and ATMs. While navigating through the city and looking at a smartphone screen, a user can see real-time information on the nearest locations, including the distance and additional details, or to book an appointment. Using the same technology, banks like Halifax and Australia’s Commonwealth Bank have used real estate data to enable potential home buyers to view detailed profiles of properties for sale as they pass them in the street.

Perhaps the best example of successful implementation of virtual banking is LiveBank. Financial institutions like Citibank, Standard Chartered, Commerzbank, mBank and BZ WBK have chosen the LiveBank solution to go virtual.

“LiveBank is a world leader in branch virtualization, multi-channel messaging and AI in customer service. Having introduced our technologies to a number of banks, we finally feel it is entering the mainstream.”

Rafał Styczeń, Ailleron CEO via

I realize that adoption of these new technologies is still in the early stages. That’s why everyone is testing everything but things are still slow to move in terms of reaching every consumer, like me and you. It may be that some of these technologies will prove to be incompatible with consumers expectations or regulatory requirements or even with the banking system itself. Being a tech lover, it was easy for me to fall into the trap of “AR and VR coming soon to a bank near you” when, in fact, they have been here for quite a few years and we’re still trying to figure out how they really work.

Not everyone is like me, it seems

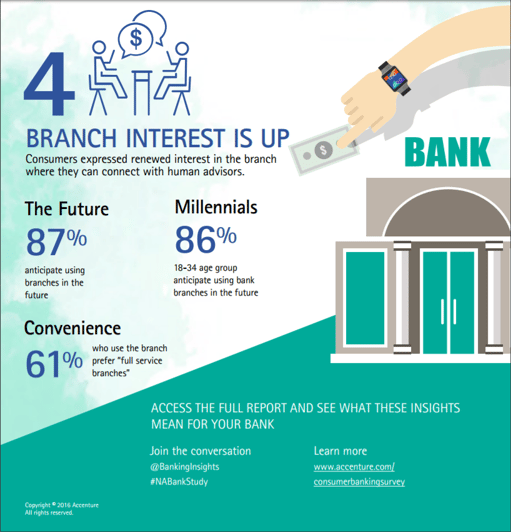

I was surprised to find out that many people still prefer having a local branch to go to. It seems they enjoy getting phone calls, as opposed to me. In the 2016 North America Consumer Digital Banking Survey by Accenture, the vast majority (87 percent) of respondents, including 86 percent of Millennials, reported that they will use their local branch in the future. For them,the branch will remain relevant because it is the place where they can connect with their banks’ human advisors. In fact, consumers most commonly reported that they will use the branch in the following 2 years because “I trust my bank more when speaking to someone in person” and “I receive more value from my bank when speaking to someone in person”.

I was not expecting that. Given that I, the tech-lover digital consumer, was the subject of so many articles and studies validating my need for accessibility, instant gratification and perpetual connectivity, I thought there were more of us out there to speed the digitization of banking services.

I still think I have a strong case for virtual banking

In my world, or as I like to call it, The Internet of Me, virtual banking remains a top priority. The reason why I believe in its slow but sure success is that people are becoming more connected everyday. In a 2016 study by the Pew Research Center and Elon University’s Imagining the Internet Center, when people were asked “Will people’s trust in their online interactions, their work, shopping, social connections, pursuit of knowledge and other activities be strengthened or diminished over the next 10 years?”, 48% chose the option that trust will be strengthened. Trust is the currency of technology adoption, the way I see it.

Yes, it seems most people today still trust a human face more than a virtual assistant. But as technology will become an intrinsic part of their lives, I believe they will extend this trust to virtual banking as well.

“People who did not trust online retail a decade ago now purchase games, music and media on a regular basis (they’re still a bit wary of deliveries from China, but they’re coming around to it). People who did not trust online banking a decade ago now find it a much more convenient and inexpensive way to pay their bills. They also like the idea that their credit cards are now protected.”

Stephen Downes, researcher at National Research Council Canada via

I say bring on the virtual banking revolution. We’re ready for it.

Signed, yours truly, the average banking user.