The digital revolution is more about people than it is about technology. At least, that’s what I’ve come to believe after hundreds of projects and software solutions. The complexity of technological solutions is, or rather it should be, designed to deliver simplicity for people using them. And not only simplicity but real assistance.

Even the term user can point us into the wrong direction. It puts everyone using our product or solution in a mold. These users are in love with our platform, they welcome all notifications and they are delighted by every new rollout.

“The term user is a self-serving construct, invented to make us designers feel like there’s a ready-made audience for our products or services.”

via uxdesign.cc

Thinking of users instead of real people makes it easy to project our own worldview as a universal truth. This bias often leads to unsuccessful platforms that never achieve product-market fit because they do not solve real customer pain points. Humans cannot fit into a mold; they are varied, complex and increasingly digitally-savvy. Designing smart business platforms for them requires us to translate their complexity into technology-enabled simplicity.

Human centered design

As we try to understand how today’s digital customer thinks and how they use products and services, we need to let go of our own biases and observe real-life people in real-life situations, to see how they react and what their goals are.

IDEO is one of the most innovative and award-winning design firms in the world. They are widely recognized as a leading force in human-centered design. Their main focus when designing products is empathy for the people who will be using them. Their belief is that what humans really want can be found out by doing two things:

- Observing user behavior — Trying to understand people through observing them.

- Putting yourself in the situation of the end-user — Understanding what the user experience is really like and feeling what their users feel.

The company defines human-centered design as a creative approach to problem solving that starts with people and ends with innovative solutions that are tailor made to to suit their needs. Their Field Guide to Human-Centered Design states:

“When you understand the people you’re trying to reach—and then design from their perspective—not only will you arrive at unexpected answers, but you’ll come up with ideas that they’ll embrace.”

The framework is based on 6 essential stages: observation, ideation, rapid prototyping, user feedback, iteration and implementation. Each of these stages focuses on real people and their problems, not on internal processes or general assumptions.

In the first stage, business platform creators are required to observe the end-user, learn and think of creative possibilities to offer them simple solutions to their problem. The goal is to understand the people they are designing for. Once they’ve identified patterns of behavior, pain points, and places where users have a difficult time doing something, they can put themselves in the exact situation to see what kind of experience they would have.

In the ideation phase, the product team can start brainstorming ideas based on what they’ve observed and come up with as many ideas as they can. Although this is a creative process, team members are required to stay focused on the needs and desires of the people they’re designing for.

Building a simple prototype of the final idea is the next step. This prototype will then be used in the user testing phase, which is the most critical phase of the human-centered design process. This stage will reveal whether or not the platform provides a real solution.

The fifth phase, iteration, is where the team uses the feedback they received to change and amend their design. Multiple iterations, testing and user feedback sessions are required until the final version of the product is achieved.

The process does not end with the implementation phase. Instead, it begins anew with every product update, as the customer’s habits and needs often change as they become more exposed to technological solutions.

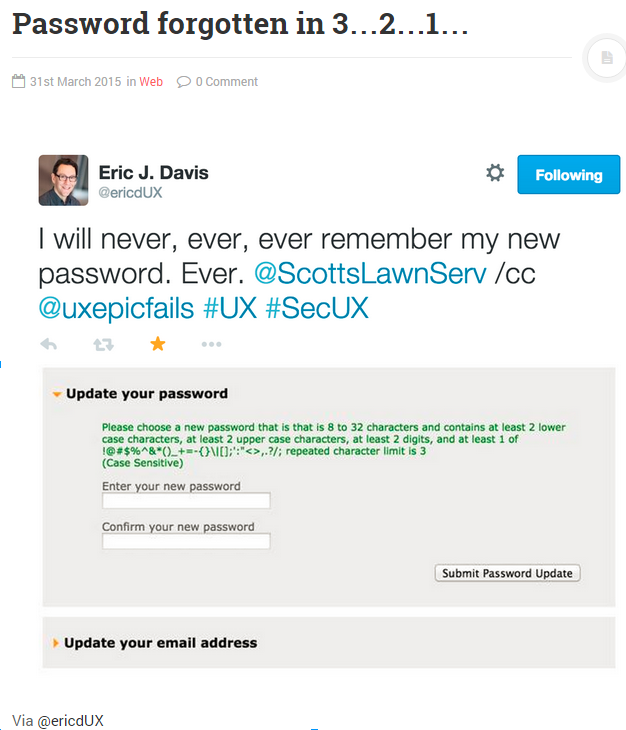

A lot of time and effort goes into creating effective and intuitive user experiences, and for good reason. One IT system development study showed that overall only 30% of software products are fully successful, while 70% either fail or produce some marginal gain to the organization. The most common cause for that are failures of utility and usability. What that means is that more often than not systems failed to perform the function they were devised or that they failed to meet the expectations of the people using them. Sometimes the blockage is in the little things, where you normally wouldn’t think to look. For example changing a password on an online account. Easy, right? Not if you’re required to include capital letter, a lowercase letter, a special character, nonsequential numerical values, a reference to a non-fiction writer who lived between the 1820 and 1859.

Image via thenextweb.com

Providing a human experience

Let’s take financial products and services for example. Traditionally, financial digital products have always been intrinsically complicated. CRMs, ERPs, banking systems – they were all designed for internal bank processes and not for the human customers that were going to use them. As design thinking grew more popular and entered the C-suite, Fintech startups have begun to replace cumbersome, complicated products with minimalistic, functional interfaces.

TransferWise is one such example. Founded in 2011, the startup targeted one of the biggest pains faced by the modern day banking consumer – overpriced international money transfers. The starting point was the genuine pain that the founders themselves experienced when they had to transfer money between the UK and Estonia. A common problem with what now seems a simple and intuitive solution became a company employing over 450 people, claiming to have saved their customers “£22 million in hidden charges”.

Another great example is Stripe. Taking on established companies like PayPal, SagePay and Skrill, Stripe managed climb fast to popularity because of its flexible and beautifully designed gateway. Their user-friendly interface was designed for real human needs, allowing businesses to implement and customise their payment gateways in apps or on websites.

Instead of designing for anonymous users, banks and financial institutions should design for Anna, the busy mom who needs her spending app to tell her not only what she spends but what she’s going to spend in the next 6 months and how best to manage her spendings and savings to get her son into a private school next year. Design for Jim, the musician who actively hates setting foot inside an insurance office but who just bought a new car for which he wants to set-updigital-only insurance policy within minutes, using his phone.

At TJIP we use the Agile methodology that allows us to involve real users throughout the design and development processes. Our teams are constantly building and testing, working quickly to deliver improvements to a service. Their focus is how to best meet the needs of real people, releasing code regularly and working in an Agile way. Our functional testing and automation processes help us us maintain a high quality level for our platforms.

Our entire way of working is based on understanding and serving the needs of real digital customers. Every day we learn something new about what they expect and how they want to use our products so we always keep an open mind and try to find creative applications for technological solutions that we build for our clients.

![Also read: Fintech trends & predictions [e-book]](https://no-cache.hubspot.com/cta/default/2537587/de58105f-ba66-405e-bc49-b5bf283fbf36.png)