My relationship with my phone has really evolved over the years to the point where I am now one of those people who takes their phone with them into every room in the house. I try to limit my phone time in order to get other things done and manage my other relationships but I couldn’t imagine going a week without it. Especially when it comes to managing my finances - my phone is my financial advisor, my piggybank, my wallet, my loan consultant, basically my portable banking assistant.

My relationship with my bank has also evolved. In fact, I’ve switched banks three times in the past 8 years because of bureaucracy, lack of accessibility and, most importantly, bad customer service. The bank that I’m currently with is the winner for me, especially since they don’t ask me to make unnecessary visits to their headquarters. I actively feel like they are trying to meet my needs and expectations when it comes to mobile accessibility, transparency and customer service.![Also read: Fintech trends & predictions [e-book]](https://no-cache.hubspot.com/cta/default/2537587/de58105f-ba66-405e-bc49-b5bf283fbf36.png)

As a late Millennial, I gravitate towards banks offering a simpler, more transparent description of their products. And I don’t like to pay for services they can conduct themselves. This is why I conduct most of my banking online, either on my mobile app or my Internet banking account. In this new Internet of Me talk, we’ll be looking at the many reasons why banks should not expect us to come to the branch for mundane things such as opening an account, getting a loan or, God forbid, paying our bills.

My phone is my preferred day-to-day banking medium

If you’re anything like me, you probably use a mobile banking app as well to track your incomes and your debts, to register your expenses and check your balance every few days. In fact, 4 in 10 smartphone owners turn to their phones for finance activities. In a survey by Google and Ipsos, 41% of respondents declared that they use their smartphone for finance-related activities. Of those, 82% said that they use finance features at least weekly.

If I want to plan a trip for the holidays, I’m going to check my account balance in my phone, as I’m discussing my vacation with my friends. My mobile app also has a data visualization of my spending habits, helping me to assess what my budget will be. I can also access my savings account and transfer money to some friends for the plane tickets so that we can book them today. All from my phone.

Small things like these are real lifesavers. They’ve saved me hundreds of trips to the bank and countless interactions with utility providers, all with different schedules and headquarters. When my paycheck comes, I have automatic payments scheduled to my phone provider, my energy provider etc. I even pay my parent’s bills to save them the trouble of going to the bank.

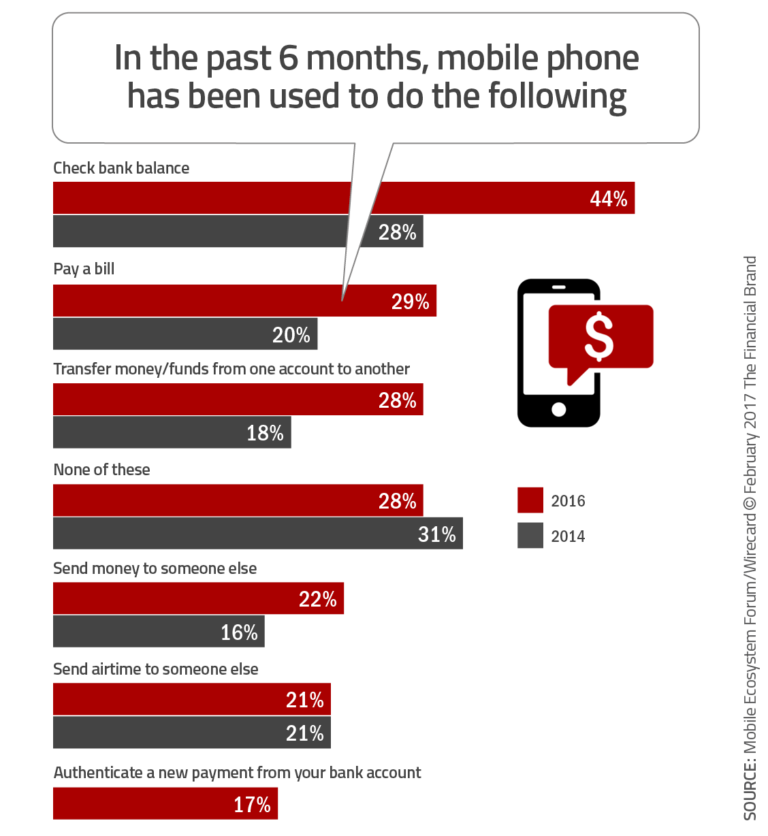

Apps are easy to use and to navigate. They are considerably more convenient than going to a physical location. On top of that, I admit I do feel special when I get personalized notifications on my phone and a unique mobile experience in my banking account. In Mobile Money Report nearly two-thirds of consumers (61%) said they now use mobile for their banking, with 44% using apps to check balances (up from 28% in 2014), 29% using apps to pay bills (up from 20% in 2014) and 22% sending money to another person (16% in 2014).

When it comes to research, I will go on my desktop

There are some activities that I feel require more time and attention that I usually end up conducting from my laptop. I did this when I was researching my current bank, looking at their financial products and services, and customer reviews and testimonials, as well as their customer service info.

A big reason for this is simply timing. If I have a time-consuming activity that also requires my increased attention, I’ll probably be doing it between 10am-5pm, when I’m normally using a desktop computer. Sure, I’ll also be using my phone for a two factor authentication, but I like to be able to compare and read information on a big screen.

33% of consumers start mobile research with a branded website, only 26% with a mobile app. (Smart Insights via)

For example, taking out a small personal loan is something I’ve done on my phone. But if I had to take on a bigger loan, say to buy a house, I’d definitely want to spend a few days reading and researching my options, as well as discussing them with my partner. And if you have an online loan calculator, that’s just perfect.

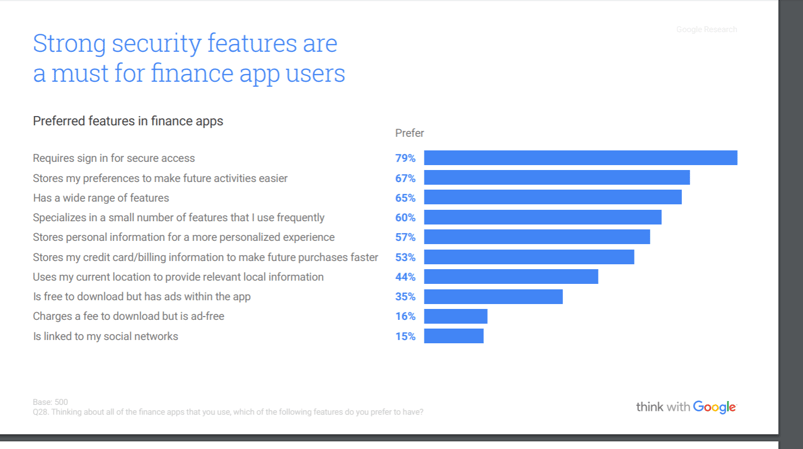

I chose online. Make sure you make it secure

If I had to name the two most important features that I look for in banking online and mobile system, they would be simplicity and security. Simplicity-wise, I’ve already expressed my views on what I would expect from a banking experience in my previous article on The Internet of Me where I discussed virtual banking.

Closely linked to simplicity, security is one of my main concerns. I mean we do live in very connected world. Technology has advanced pretty fast but so did criminality. I haven’t been the victim of a phishing attack so far but I do have friends who have been. A simple text message was enough to hijack their entire account.

I’m personally a big fan of biometrics for banking authentication. I recently read a case study about one of the world’s first mobile-only banks - Bunq. Based in Amsterdam, Bunq has risen quickly in popularity in its home country, and is quickly expanding across Europe since it started in 2015. One of the main problems they encountered as a mobile-only bank was securing their authentication process to protect customer finances. Initially, they decided to use biometric authentication to confirm users identities whenever they performed actions like high-risk transactions or resetting account limits. The process is similar to taking a selfie, a common enough behavior.

For me, fingerprinting made more sense, but it seems that the reason they opted to not use built-in fingerprint sensors was because they thought it would be limiting for their customer-base, especially if a user’s device didn’t include fingerprint capabilities. It is also not as secure as we all would like to think. Remember how In 2014, one hacker demonstrated his method for faking fingerprints using only a few high-definition photographs of his target, German defence minister Ursula von der Leyen? Jan Krissler used commercial software called VeriFinger and several close-range photos of his target, including one gleaned from a press release issued by her own office and another he took himself from three meters away, to reverse-engineer the fingerprint.

Another reason why facial recognition isn’t the most secure biometric is because it has a high rates of false rejection – when the application incorrectly rejects an authorized user’s authentication attempt. The solution that Bunq came up with is to use a contactless hand recognition biometric that could easily collect a user’s several fingerprints using just the rear camera and LED flash of their smartphone. Veridium’s 4 Fingers TouchlessID doesn’t rely on ideal lighting conditions for authentication quality, as opposed to facial recognition. When compared to single mobile fingerprint sensors they are able to get not just one complete print, but four, which makes it one of the most secure mobile biometrics on the market.

When it comes to mobile apps, there are a number of features that we expect to see, security-wise. Personally, I also want to be alerted of any issues regarding account privacy and security of my finances.

We’re all adapting to the third wave of the Internet. For me, as a consumer, it brings a lot of freedom and flexibility. For banks, it requires a lot of effort to keep up with new consumer expectations and finding new ways of putting them at the center of the banking experience.

The more we work together to figure out how every channel can be integrated into a seamless, connected experience, the more satisfied we’ll both be. Me, as a consumer who is relying on their phone for day-to-day banking operations, and you, as a bank and a business who wants to create relevant financial products and drive customer loyalty.

![Also read: Fintech trends & predictions [e-book]](https://no-cache.hubspot.com/cta/default/2537587/de58105f-ba66-405e-bc49-b5bf283fbf36.png)