Contrary to many dire predictions, most banks today have recovered remarkably well from the global financial crisis. With new capital infusions and sustained growth, they continue to benefit from their customer’s trust, after playing an important role in their lives for decades. The rise of fintech startups and the new digital customer mindset have been contributing to a digitalization of the world’s banking systems. The most notable aspect of it is self-service banking, a relatively new way of managing finances, connecting with financial institutions and navigating key aspects of our daily lives.

Differentiation is harder in today’s economy of commoditization. For most people, it doesn’t really matter which bank they choose to do business with since they all do the basic job of keeping their money safe. With most banking products are becoming commodities, banks have to work harder to differentiate themselves through rates, fees, advice and, most importantly, customer experience. Self-service banking is a key aspect of a positive customer experience forthe digital consumer who uses their mobile phone to check their account balance while waiting in line at a coffee shop.

Self-service is an intrinsic aspect of the age of the customer, where the relationship with the bank and the experience they provide is the key to sustaining growth. People are familiar with the concept of self-service or in the case of retail technology self-checkout and they’ve come to expect it. In a recent survey, self-checkout rated highest out of a variety of retail technology on a “consumer consciousness scale” with 71% of shoppers declaring that they were familiar with the concept.

Mobile banking

A key aspect of self-service, mobile banking has already gone mainstream. According to the Mobile Ecosystem Forum’s recent Mobile Money Report, 61% of people use their mobile phone to carry out banking activity, with 48% using a dedicated banking app.

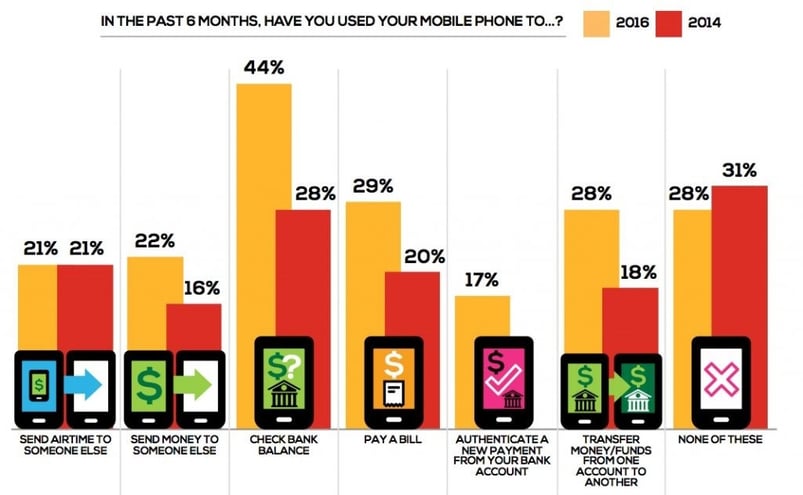

Since The Mobile Ecosystem Forum last studied the mobile money landscape in 2014, the number of people who check their balance on a smartphone has increased from 28% to 44%, which makes this the most common activity within a mobile banking app. People are also more comfortable with paying bills in an app—29% in 2016 compared to 20% in 2014—with 22% sending money to other people through the app—an increase of 6%, according to the same report.

Source: Mobile Ecosystem Forum, Mobile Money Report

Kiosks

Self-service kiosks are another element of self-banking, providing at least part of the convenience that digital consumers are seeking in local branches.

Earlier this year, Source Technologies launched the Personal Teller Machine, as the only solution in the market that includes self-service check issuance and on-demand printing capability. The self-service kiosk offers 9 different routine transactions: cash withdrawal in any denomination, deposit cash and checks, get cash back, account transfers, access and print statements, check account balances, stop payment, issue official checks and bill payment.

But is this enough for the digital customer?

What’s next?

Cardless transactions

Source Technologies have previewed a version of the smart ATM that is on the next evolutionary step of self-service banking. Cardless transactions at ATMs are designed to drive customer experience to the next level of convenience and potentially give financial institutions innovative value and utility from their mobile apps. Financial institutions such as Wells Fargo are already seizing this opportunity in the U.S. In March this year they announced that their 20 million mobile app customers would be able to withdraw cash from all 13,000 of the bank’s ATMs using nothing more than their smartphones. The E.U. is also following the trend. CashDash, a cardless ATM cash withdrawal service, recently launched in London with a network of 53 ATMs. The service is powered by the CashDash mobile app, which currently is available from Google Play for Android devices, and soon will be available for the iPhone as well, according to the company's website.

A 2016 survey on ATM and self-service software trends shows that cardless and contactless transactions rank high on financial institutions’ four-year wish list — with 68% saying they were pursuing such initiatives.

Although this has been a speculated banking trend for the last few years, it is still more a part of the future than the present. Experts like Mark Shonebarger VP Retail Finance at Huntington Bank, believes that without a “standardized methodology to accept mobile-based transaction everywhere” massive adoption is unlikely. “It can’t just be at one point or another, but it needs to be accepted at all points to be really useful”, he said.

Chatbots

The most popular application of Artificial Intelligence in banking, chatbots are conversational, personal and predictive. By enabling customers to interact with the bank through natural language conversations, chatbots provide an intuitive channel for customer inquiries, facilitating user friendly interactions and delivering a better customer experience.

While in tech circles they are not by any means a new thing, they are still an element of futuristic banking for most customers. In 2016, one of the largest U.S. banks, Bank of America announced Erica, a voice- and text-enabled chatbot for their customers. But while Erica was covered by all major publications as the up and coming intelligent digital assistant designed to help customers make smarter banking decisions, the chatbot has only been rolled-out this month to 300 of the bank's employees. In March at SXSW 2017, Capital One also launched an invite-only pilot for their banking chatbot called Eno. The bot has also been released for all Capital One U.S. credit card and bank customers just this month.

As for the E.U., Sweden’s SEB bank is one of a handful of large banks and insurers (including UBS and insurer VGZ) that have enlisted the help of chatbots or cognitive agents to deal with customers. SEB is currently working with software company IPsoft to get a cognitive agent called Amelia to act as a front-end customer service agent.

How will these chatbots live up to their potential? According to a report released by Juniper, chatbots will be responsible for over $8 billion per annum of cost savings by 2022. Another report by Gartner, states that consumers will manage 85% of the total business associations with banks through Fintech chatbots by 2020. I guess we have to wait and see if these numbers play out.

Building a Connected Ecosystem

While there are a number of other technologies and solutions that define the “future of self-service banking”, the ideal scenario is one where financial institutions build connected ecosystems. None of these solutions will thrive on their own. In order for these solutions to offer a convenient and intuitive experience to digital customers, they need to be connected themselves.

For the digital consumer, this means having their phone, desktop, tablet, card, ATM interactions all linked together so that when they access on one of the devices, the others are immediately “notified” and suggest the next step for the consumer, instead of them having to use each solution individually. We call this an omnichannel environment.

If in the past we had a multi-channel approach to banking as the number of touch points increased, today these touch points are complicating IT systems and consumer experiences to the point where a unification solution is needed. The omnichannel approach aims to provide that solution by introducing more consistent interactions with the banking brand across the various touch points. Think of how many times you’ve been offered an unwanted loan by your bank and subsequently been targeted with the same question while carrying out your online banking? What if the system would know that you have already been asked that question on one device so as not to target you further on a different one? Wouldn’t that bring about a more pleasant experience?

For the bank, all the customer data and all their interactions need to be synchronized to offer a seamless backend experience. This means systems that can support incoming information from multitude of devices, touch points and the challenges that come with them from both a security point of view, as well as from a usability one. Such a 360 degree view of all of your customers’ activities will also allow you to see spending and income patterns. This is when data points become valuable information.

“Built on a multichannel strategy that allows anytime, anywhere, any device access with consistent experience across channels, omnichannel enables interactions across multiple customer touch points where intents are captured, insights are derived and conversations are personalized and optimized. With omnichannel, banks can not only fulfil customers’ explicit needs, but also anticipate their wants and likes.”

Conclusion

While mobile banking is becoming a mainstream trend, banks need to think beyond mobile if they want to engage and retain digital customers. Some of the technologies already available to banking customers such as kiosks and cardless transactions are already putting pressure on coordinating multiple devices and multiple touch points. Banks will need to design smart business platforms that can handle these new technologies and bring them together to offer seamless customer experiences.

Creating an omnichannel banking environment is one such solution but it’s harder to implement that the theory would have us believe. Implementing a core platform to support integration of data points to surface customer-centric data insights will not be easy for most financial institutions. But hard doesn’t mean impossible. Designing such a smart business platform would be a challenge that our specialists at TJIP would surely welcome.